It is just about everyone's dream to have a house of their own someday. The peace of mind, the sense of freedom and security that come with home ownership - being one's own landlord - is an incredible feeling. Being able to live in the privacy of one's own home and not to be at the mercy of any landlord anymore can be a very liberating experience. Thus buying a house gives people a huge psychological boost. Moreover, buying a house is a more tangible investment than living in a rented accommodation because in the latter case, we have to pay the rent (which invariably gets increased every year) every month and so feels like "wasting" money. Taking a home loan from a bank and shelling out the monthly EMI to purchase our own house feels a far better financial move. Not just that, one also gets a tax deduction on the loan interest.

So in India, home ownership remains one of the major goals in life for most people, all the more so when they have settled down in their careers and have attained financial stability. Buying a home would be one of the biggest purchases one will ever make and thus is a major decision. It can be exciting but at the same time can seem like an enormous task, especially when someone would be buying his first home.

Ever since they got married some six years back, Anirudh (my colleague) and his wife Seema had been planning to buy their own house. Finally four years later, they decided to take the plunge and purchased their own flat in a posh apartment society in Gurgaon. They had been saving all through this period for this very purpose and had saved enough to fund 40% of the flat's price for paying to the seller. For the balance amount needed to complete the purchase, they decided to take a fixed rate home loan of Rs 35 lakhs with a tenure of 20 years from the CBN Bank which was offering home loans at an interest rate of 11.5% per annum at that time. For most of the first time home buyers, a bank housing loan seems to be their best bet.

After an exhaustive paperwork and verification process, the CBN Bank sanctioned their loan and Anirudh and Seema could pay the entire amount to the property seller to complete the purchase. For them, it was a huge accomplishment when they finally took possession of their flat.

|

Home Loan Facility from Banks

Image Source: www.indiatoday.in |

Their joy was however soured when Anirudh came to know that in the four years starting from the time he took the home loan, the CBN bank had gradually reduced its interest rate based on the market fluctuations. Currently the interest rate stood at 10.25% per annum. But Anirudh couldn't reap any benefit from this reduction in the interest rate because he had opted for a fixed rate home loan. He contacted the bank and requested them to convert his home loan to a floating rate loan. He had been paying his EMIs (Rs 37,325 every month) diligently all this while and so was hoping that the bank would accede to his request. Instead, they outrightly rejected his request. Thus he was in a way being forced to continue paying at a higher interest rate. Since he was at the starting phase of his home loan (only four years of the twenty year tenure had passed), so he was going to lose a substantial amount of money if he had continued with the same interest rate of the CBN Bank.

Luckily at this time, Anirudh came to know about the Home Loan Balance Transfer facility. By availing this facility, one can get his existing loan of the original lending bank transferred to a second bank or financial institution that is offering the loan at a lower interest rate.

The process of Home Loan Balance Transfer is fairly simple:

- The loan borrower submits an application to the original lending bank requesting for the loan balance transfer and obtains a consent letter or no objection letter from it.

- Upon submitting the NOC letter to the second bank (the one that is offering the loan at a lower interest rate), it pays off the entire outstanding principal amount of the loan to the first lending bank and thus the loan deal with the original bank gets closed.

- The first lending bank then hands over the property documents to the second lending bank.

- From now on, the loan borrower has to pay the EMIs to the second lending bank at the new (lower) rate of interest.

The advantages of the home loan balance transfer are many. For instance, after transferring the existing loan to a second bank that offers a lower interest rate, the loan repayments get lowered and so also the monthly instalments. Thus one can save a great deal. With a lower interest rate, the home loan now becomes much more affordable. Moreover now with the balance loan transfer option available, one can take advantage of the customized repayment options as per one's needs.

However this Home Loan Balance Transfer is beneficial only if it's done early on during the loan tenure. Also the second lending bank might charge a processing fee for the Balance Transfer of Home Loan.

But then there are so many banks and financial institutions offering the Housing Loan Balance Transfer facility and so Anirudh was confused about which bank to go to for the Balance Transfer of Home Loan. It was here that Sanjay, a colleague of ours, recommended Bajaj Finance to him because he had himself benefited a lot from Bajaj Finserv’s Home Loan Balance Transfer facility and had saved a considerable amount of money because of its lower interest rate and thus resulting in lower monthly instalments.

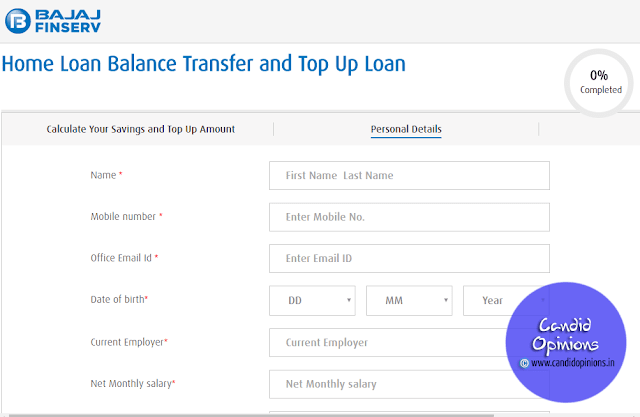

Upon Sanjay's advice, Anirudh visited their website and went through the procedure (which is fairly simple). One only needs to calculate his savings on Home Loan Balance Transfer and Top Up calculator and fill up an online Home Loan Balance Transfer application form and he did just that.

|

| Calculate your savings with Bajaj Finserv's Home Loan Balance Transfer |

|

| Calculate your savings and Top up amount |

|

| Bajaj Finserv's online Home Loan Balance Transfer application form |

His application was approved and his existing home loan from the CBN Bank was transferred to Bajaj Finserv. By doing that, not only will he be saving a total of Rs 9,35,130 over the 20 year tenure of the loan, but he could also avail a Top Up Loan amount of Rs 7,00,000 for the additional furnishing of his new flat. That was like icing on the cake! He couldn't have asked for more.

Bajaj Finserv offers several advantages to the loan borrower when he/she avails its Housing Loan Balance Transfer facility -

(1). The application process is entirely online and even the approval is online and almost instant. In fact the online Home Loan Balance Transfer from other banks can even be disbursed within 4 days.

(2). Additionally one doesn't have to worry about any tedious paper work as with Bajaj Finserv, the documentation is minimum;

(3). It offers Pre-payment facility and also there are no charges for Part Pre-Payment of the loan amount;

(4). There are no hidden charges;

(5). There are no foreclosure charges;

(6). One gets access to an Online account as well as customised insurance schemes;

(7). One also gets 3 EMI free months.

(8). Bajaj Finserv also offers a Refinance option. Even if one hadn't taken any home loan from any bank and instead had purchased his property with his own money, he can still avail Bajaj Finserv's Balance Transfer facility and can take a loan up to the registered value of his property, provided he had purchased the property in the last 12 months.

(9). Bajaj Finserv also provides an option to take a Top-up Loan at a minimal rate of interest, to the borrower when he opts for a Home Loan Balance Transfer. This top-up loan money can be used any which way, be it for home furnishing or on a holiday or some other personal use. One can also avail a fresh Home loan at a interest rate of only 9.50% per annum.

Thus for obvious reasons, Bajaj Finserv has remained the popular choice from among all other banks and financial institutions for availing the Home Loan Balance Transfer facility.

Having enjoyed the benefits of the Home Loan Balance Transfer facility provided by Bajaj Finserv, Anirudh now just can't stop singing its praises and understandably so. After all, Bajaj Finance proved to be his saviour in his hour of despair.