We all nurture dreams and set goals for ourselves and for the ones we love. Therefore we word hard to fulfill those dreams and achieve those goals. However, Life is not always a smooth-ride, it can be very unpredictable. We never plan to fail, but then sometimes life throws such difficult challenges at us that we are caught off-guard. We never know what situations may arise in the next moment. For instance, a death in the family is very agonizing for the family members but it becomes even more harrowing if the dead person happened to be the sole bread-earner. So one needs to have a robust financial plan in place for a secure future and to shield oneself and his family from any unforeseen adverse circumstance.

Three years into his career, the 24 year old Avinash Biswal is well settled and earns handsomely working as a software engineer in a MNC. And like any other financially independent young man, he too wishes to lead a luxurious life. He too nurtures a few short-term goals like buying a house and so also a sedan. Nobody is promised tomorrow and therefore one may be tempted to enjoy his earnings now. But Avinash has always resisted the impulse to splurge and instead has been smartly managing his money right from the time he started earning, with careful investments.

He tied the knot last year and is going to start a family soon. Thus his responsibilities have now increased. So not only does he need to allocate his savings prudently to meet the increased expenses and liabilities but he also needs to provide a cushion for any untoward eventuality that he or his family could face in the future.

Therefore Avinash had been looking for a reliable long term investment cum protection plan - ULIP (Unit Linked Insurance Plan) since some time. A ULIP not only provides life insurance protection to the policy taker but also offers him an opportunity to avail market linked returns. Thus the buyer gets both insurance as well as investment benefits under a single integrated plan!

|

A ULIP plan to secure your family's future

(Photo Source: www.idahoaffordable.com) |

His prayers were answered with the launch of ‘iNVESTSHIELD’ - a ULIP offered by Canara HSBC Oriental Bank of Commerce Life Insurance. The Investshield plan of Canara HSBC OBC Life Insurance has been designed to protect and fulfil an individual's current and future financial requirements. With the iNVESTSHIELD Plan, one gets the opportunity to create wealth to achieve various short-term goals and family needs and so also to ensure a worry-free future for his family.

|

iNVESTSHIELD’ - a ULIP offered by Canara HSBC Oriental Bank of Commerce Life Insurance

(Photo Source: www.canarahsbclife.com) |

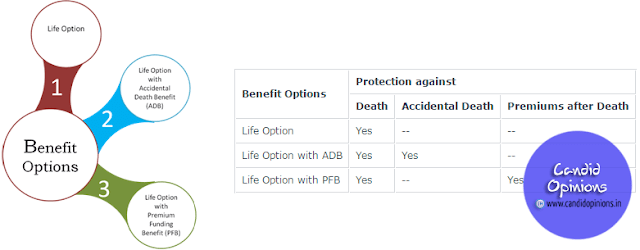

There are three Benefit options in the iNVESTSHIELD Plan -

(1) Life Option that provides financial protection against natural death

(2) Life Option with ADB that provides financial protection against natural death as well as accidental death

(3) Life Option with PFB that provides financial protection against natural death as well pays the premiums on the insurer's behalf so that the nominee continues to get the benefits.

|

Benefit options in the iNVESTSHIELD Plan

(Photo Source: www.canarahsbclife.com) |

One can choose any of the three benefit options and customize his plan accordingly. However one should be aware that he can choose a benefit option only in the beginning. Once an option has been chosen, it cannot be changed later during the Policy Term.

In case of the unfortunate demise of the insured life, his/her family will get the death benefit as was chosen by the policy buyer. For instance,

if one had chosen "Life Option", his/her family will get the higher of the three:

- the Sum Assured less applicable partial withdrawals

- the Fund Value, or

- 105% of the Premiums paid

If one had chosen "Life Option with ADB", his/her family will get twin Benefits -

- Death benefit as per 'Life Option'

as well as

- the Sum Assured under Accidental Death Benefit (ADB). The ADB Sum Assured will be equal to Sum Assured of the Policy and will be payable in case death of the Life Assured is due to an accident.

If one had chosen "Life Option with PFB", his/her family will get higher of the following as lump sum and that will be paid immediately:

- the Sum Assured or

- 105% of total Premiums paid till death

Additionally,

- All future Premiums will be funded by the Canara HSBC Oriental Bank of Commerce Life Insurance Company as and when due, and the Fund Value will be paid to the family on maturity.

The table below will give you a more clearer idea about the iNVESTSHIELD plan -

|

iNVESTSHIELD Plan of Canara HSBC OBC in a nutshell

(Photo Source: www.canarahsbclife.com) |

Why Buy the iNVESTSHIELD Plan?

Are you still doubtful about buying the iNVESTSHIELD Plan? Well, the Key benefits of iNVESTSHIELD Plan are as follows:

(a) One gets the convenience to buy directly from the website www.canarahsbclife.com

(b) It offers the flexibility to the policy buyer to customize his plan as per his need.

(c) Zero Premium Allocation Charge is another benefit that one gets throughout the premium payment term of his Policy

(d) One also gets Loyalty Additions as additional allocation of units to boost his investments

(e) One gets the Choice of Investment Funds ranging from 0% to 100% equity exposure, as per his appetite towards investment risks and returns

(f) There is also a Safety Switch Option that enables the policy taker to move his funds systematically to a relatively low risk Liquid Fund to avoid market movements in the last four Policy years

(g) There is the additional benefit of Liquidity - i.e. one can take partial withdrawals from his Policy without completely surrendering it, to help him meet unplanned contingencies. Partial withdrawals are allowed from the 6th Policy Year.

(h) Apart from all the above mentioned advantages, one also gets Tax benefits on the premium paid and also on the benefit received during the Policy term under Section 80C and Section 10(10D), as per the Income Tax Act, 1961, as amended from time to time.

The best part is that one would not have to go through a cumbersome process like the usual insurance plans but instead can get oneself insured by filling up the online application form, at the touch of a few buttons! It's that simple.

|

Application form of iNVESTSHIELD Plan

(Photo Source: www.canarahsbclife.com) |

After carefully studying its various features and consulting with his family, Avinash was convinced and decided to take the iNVESTSHIELD plan of Canara HSBC OBC Life Insurance to ensure a secure future for his family. Like Avinash, you too can secure your finances and future wisely and buy the peace of mind by taking the #InvestShield plan of Canara HSBC OBC Life Insurance and thereby strengthening the warrior in you to fight the uncertainties of life.

|

#InvestShield Plan

(Photo Source: www.canarahsbclife.com) |